Viewpoint... The impact of capital reserves under the new Company Law....................................................................................

Published:

2024-06-27

The new "Company Law" will come into effect on July 1, 2024. The use of capital reserve is one of the substantive amendments. This article mainly analyzes the concept of capital reserve, the legal provisions for capital reserve to make up for losses, the legal analysis of capital reserve to make up for losses, and the impact of capital reserve to make up for losses on the company, hoping to provide a reference perspective for everyone.

The new "Company Law" will come into effect on July 1, 2024. The use of capital reserve is one of the substantive amendments. This article mainly analyzes the concept of capital reserve, the legal provisions for capital reserve to make up for losses, the legal analysis of capital reserve to make up for losses, and the impact of capital reserve to make up for losses on the company, hoping to provide a reference perspective for everyone.

1. what is capital surplus

Capital surplus is not a legal concept, it is a term in accounting and a common account in equity on the balance sheet, and according to Article 82 of the Enterprise Accounting System, "Capital surplus includes capital (or equity) premiums, acceptance of donated assets, transfer of appropriations, foreign currency capital translation differences, etc." In practice, when we are involved in the "capital surplus" account, it is common for investors to subscribe for the new registered capital of the subject company at a price exceeding one yuan per capital contribution, and the corresponding part of the registered capital is included in the "paid-in capital" account, while the excess part is included in the "capital surplus". In other words, the source of capital surplus is primarily formed by shareholder inputs, not by the distribution of corporate profits.

The legal provisions of the 2. of capital reserves to make up for losses.

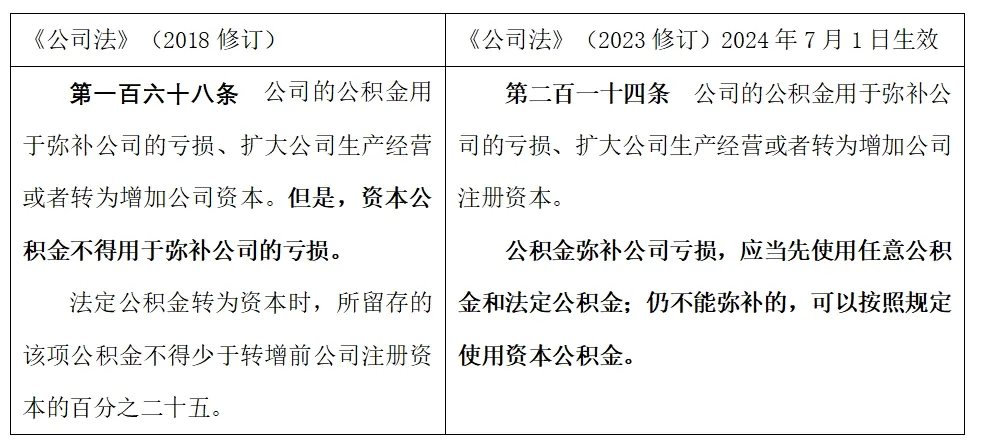

Comparison of old and new laws:

The new Company Law has deleted the prohibition of capital reserves to cover losses, which is the substantive amendment clause. The content has also undergone a process of change from "permitted" in the 1993 Company Law, "prohibited" in the 2005 Company Law to "conditionally permitted" in the latest company. The so-called "restrictive liberalization" of capital surplus to cover losses in the new Companies Act is mainly reflected in two aspects:First of all,The company law stipulates that if the provident fund makes up for the loss, the arbitrary provident fund and the statutory provident fund shall be used first, and the capital provident fund can only be used if it still cannot be made up.Secondly,There are many reasons for the formation of capital reserve, but it is mainly used to make up for losses based on the equity premium listed in Article 213 of the Company Law and the share proceeds from the issuance of non-denomination shares. For the book figure amount (such as "equity investment reserve") formed by the adjustment of financial accounts, it is not recommended to make up for losses that there are no actual assets or real cash flow behind it.

Legal analysis of 3. capital reserves to make up for losses

One of the main reasons why the Company Law of 2005 strictly prohibits capital reserve from making up for losses is that there have been cases of listed companies using capital reserve to adjust accounts and beautify the company's financial statements (typical case: triple reorganization case). The auditing authority believes that once capital reserve is allowed to make up for losses, it is easy to be reduced to a tool for operating the company's financial data, which easily leads to the risk of manipulating financial data and causing financial data fraud, this makes the company's financial statements not a true reflection of the company's situation. Secondly, based on the independent qualification of shareholders and corporate legal entities, shareholders should ensure the principle of maintaining the company's capital after investment, and should not be returned to shareholders in disguise, otherwise it is easy to be identified as "withdrawal of capital contribution".

The revision of the new "Company Law" once again clarifies that capital reserves can make up for losses. In fact, it has a lot to do with the current economic environment. It is mainly to improve investor confidence in the market and help companies solve financial difficulties.

In practice, capital surplus to make up for losses is only an internal adjustment of the "equity" account in the balance sheet, I .e., borrowing "capital surplus" and lending "undistributed profits", and does not involve capital flows, but the operation provides a legally permissible path for investment, mergers and acquisitions, etc. to achieve a certain capital operation result.

The impact of 4. capital reserves to cover losses on the company.

In view of the amendment of Article 214 of the new company law, it is suggested that the company and the actual controller should treat it dialectically and make prudent decisions according to the different situations of the company.

Advantages of (I) capital reserves to cover losses

1, so that the company, shareholders on the disposal and distribution of the company's assets to enjoy greater independent decision-making power, according to the company's situation to weigh their own decisions, conducive to the development of the company;

2, optimize the company's financial statements, for the accumulation of capital reserves is high, but the profitability of the company is not optimistic, can increase the company's earnings, to attract more external investors;

3, is conducive to the restructuring of the company, in the case of the introduction of external investors in the company's liabilities, allowing to make up for losses, can make the company as soon as possible to turn losses into profits, so that new investors as soon as possible to obtain dividends, conducive to the company's follow-up financing;

4, enhance the company's market vitality.

The disadvantages of (II) capital reserves to make up for losses.

1, the capital provident fund to make up for the loss, will make the overall tax burden of enterprises to increase.

Capital provident fund to make up for losses itself has two sides, increasing corporate profits, taxable income is positive, you need to pay corporate income tax, and may affect the income tax payment base in the next few years, resulting in an increase in the company's overall tax burden in recent years;

2. The State Administration of Taxation has no clear document on whether to pay tax on the use of capital reserve to make up for losses. Since capital reserve is not formed by after-tax profits after all, there is a claim to pay tax. Our lawyers believe that the use of capital reserve to make up for losses, especially the part formed by the premium of shareholders' investment funds, does not involve new income and is not taxable, but the opinions of the State Administration of Taxation shall prevail in the end;

3. At the pre-ipo stage, if the capital reserve is allowed to make up for the loss, it may harm the interests of investors entering the high valuation, and it is not excluded that in the investment agreement or articles of association, the motion to make up for the loss of the capital reserve is listed as a special resolution or the requirement to have one vote or not, or even to limit the loss of the capital reserve before listing. At present, the relevant laws and regulations of listed companies and the relevant supporting interpretation of the Company Law have not yet been issued, so we can pay further attention to this issue.

To sum up, the pros and cons of the company's capital reserve to make up for losses are mainly reflected in the capital strength, capital structure, earnings per share, shareholders' equity, etc., and also involves tax treatment issues. Therefore, it is recommended that the company make relevant decisions, in addition to Considering the overall structure, tax costs should also be considered to ensure the rationality and compliance of the decision.

Key words:

Related News

Zhongcheng Qingtai Jinan Region

Address: Floor 55-57, Jinan China Resources Center, 11111 Jingshi Road, Lixia District, Jinan City, Shandong Province