Point of View... Credit asset income right transfer compliance points.

Published:

2024-06-28

This paper combs the relevant concepts and compliance points of the transfer of credit asset income rights, with a view to helping financial institutions to operate in compliance when doing such business.

In late June 2024, China Construction Bank, Zhejiang Internet Commercial Bank, Guangdong Shunde Rural Commercial Bank, Immediate Consumer Finance, Ant Consumer Finance and other institutions issued an announcement on the transfer of credit asset income rights at the Banking Credit Asset Registration Asset Center (hereinafter referred to as Yendeng Center), transferring credit asset income rights to trust companies, involving an amount of nearly 10 billion yuan.

The right of return on credit assets is a kind of financial innovation in the banking industry, which is conducive to optimizing the structure of bank assets, invigorating the stock of credit, and speeding up the turnover of funds. Since the first order was made in 2014, the credit asset income right transfer business has not developed rapidly in the first few years, but it has achieved rapid development after 2020. Recently, the number of announcements and the scale of funds for the transfer of credit asset income right are also on the rise. This paper combs the relevant concepts and compliance points of the transfer of credit asset income rights, with a view to helping financial institutions to operate in compliance when doing such business.

Interpretation of Basic 1. Concepts

The transfer of non-performing assets is a common business in the disposal of financial assets, so what is the difference between the transfer of non-performing assets and the transfer of the right of return on credit assets? What is the difference between the transfer of non-performing assets and the transfer of the right of return on non-performing assets? In order to clarify these issues, we need to start with the basic concepts and analyze the differences between various products and businesses.

(I) what is the transfer of the right of return on credit assets.

To understand the business of transferring the right of return on credit assets, you first need to understand what the right of return on credit assets is. According to Article 2 of the Business Rules for the Transfer of Income Rights of Credit Assets of the Banking Credit Asset Registration and Circulation Center (for Trial Implementation) (hereinafter referred to as the Business Rules for the Transfer of Income Rights of Credit Assets), the right to income of credit assets refers to the right to obtain the principal, interest and other agreed amounts corresponding to the credit assets. In conjunction with the relevant provisions of the Business Rules for the Transfer of Income Rights on Credit Assets, the author attemptsThe business of transferring the right of return on credit assets is defined as the transfer of the right of return on credit assets held by banking financial institutions to trust companies in accordance with the law and in accordance with the principle of marketization under the supervision and management of the State Administration of Financial Supervision and Administration.

The difference between (II) credit assets and non-performing assets.

1. What is a credit asset?

There are broad and narrow differences in the understanding of credit assets.

Credit assets in a broad sense refer to the sum of all types of assets generated by a bank's lending business, including normal credit assets and non-performing credit assets. The reasons are analyzed as follows:

Article 3 of the Interim Measures for the Administration of Credit Funds issued by the People's Bank of China on February 15, 1994 stipulates that the scope of credit funds includes loan assets. In addition, in the documents issued by the People's Bank of China, the assets arising from various types of lending operations are collectively referred to as "credit assets". For example, the Measures for the Administration of Foreign Exchange Credit Funds of Banks (for Trial Implementation), issued on 9 October 1992, used "foreign exchange credit funds" and "foreign exchange credit assets" in different contexts, respectively ". From the logical point of view of the content of this document, the use of "foreign exchange credit funds" and "foreign exchange credit assets" is to express the two-way target management of the bank's foreign exchange credit business by the People's Bank of China, which is reflected in the plan for foreign exchange credit funds under the target of "issuing and assessing the annual bank foreign exchange credit plan, the management of the ratio of foreign exchange credit assets and liabilities is reflected under the objective of" setting and issuing the management ratio of foreign exchange credit assets and liabilities of banks.

The "Notice on Preventing the Losses of Bank Credit Assets" issued on February 17, 1994, the "Interim Measures for the Management and Assessment of Asset-Liability Ratio of Commercial Banks" issued on July 7, 1994, the "General Rules for Loans" issued on June 28, 1996 include "ensuring the safety of credit assets", and the "Guiding Principles for Strengthening the Internal Control of Financial Institutions" issued on May 16, 1997. "Credit assets" are mentioned in the guiding principles for loan risk classification (Trial Implementation) issued on April 20, 1998. Until August 29, 2015, the commercial bank law and other laws and regulations also take "credit assets" as a fixed term. According to the understanding of the meaning, it can be concluded that credit assets refer to the sum of all types of assets generated by bank loan business.

A narrow credit asset refers to a defined, transferable normal class of credit assets.

The Notice of the China Banking Regulatory Commission on Further Regulating the Transfer of Credit Assets of Banking Financial Institutions (No. 102 [2010] of the China Banking Regulatory Commission, hereinafter referred to as No. 102) defines credit assets as definite and transferable normal types of credit assets.

According to the Guidelines on the Classification of Loan Risks issued by the China Banking Regulatory Commission, commercial banks classify loans into at least five categories: normal, concern, substandard, doubtful and loss, of which the normal category means that the borrower is able to perform the contract and there is no sufficient reason to suspect that the principal and interest of the loan will not be repaid in full and on time. Thus, a narrow credit asset is a loan asset that is determined and transferable by the borrower to perform the contract without sufficient reason to suspect that the principal and interest of the loan will not be repaid in full and on time.

2. What are non-performing assets?

China Asset Assessment Association on the issuance. <金融不良资产评估指导意见> The Notice defines non-performing assets as subordinated, doubtful and loss-type loans held by banks, non-performing financial claims acquired or taken over by financial asset management companies, and non-performing claims held by other non-bank financial institutions.

Similarly, according to the Guidelines on Loan Risk Classification, loans are divided into five categories: normal, concern, substandard, doubtful and loss, of which the latter three categories are collectively called non-performing loans, of which substandard refers to the borrower's ability to repay the loan principal and interest in full due to obvious problems. Even if the guarantee is implemented, certain losses may be caused. Suspicious category refers to the borrower's inability to repay the loan principal and interest in full, even if the security is enforced, it will certainly result in a large loss; the loss category means that after all possible measures or all necessary legal procedures have been taken, the principal and interest cannot be recovered, or only a very small part can be recovered.

3, the difference between credit assets and non-performing assets.

From the above analysis, it can be seen that credit assets in a broad sense can be divided into five categories according to the Loan Risk Classification Guidelines, in which the identified, transferable normal category of credit assets belongs to the narrow category of credit assets, and the secondary, doubtful and loss categories of credit assets belong to non-performing assets.

The difference between the transfer of the right of return on (III) credit assets, the transfer of non-performing assets and the transfer of the right of return on non-performing assets.

The transfer of non-performing assets mainly complies with the application of the "Approval of the China Banking Regulatory Commission on Issues Concerning the Legal Effect of Commercial Banks' Transfer of Loan Credits to Social Investors" (YJBF [2009] No. 24), and the "Batch Transfer of Non-performing Assets of Financial Enterprises Administrative Measures" (Caijin [2012] No. 6), "China Banking Regulatory Commission's Approval Conditions for Local Asset Management Companies to Carry out Batch Acquisition and Disposal of Non-performing Assets notice on issues (CBRC [2013] No. 45), notice of the General Office of the China Banking and Insurance Regulatory Commission on carrying out the pilot work of the transfer of non-performing loans (CBRC Office memo [2021] No. 26), reply of the General Office of the China Banking and Insurance Regulatory Commission on carrying out the pilot transfer of non-performing loans of banks (CBRC memo [2021] No. 27), and the General Office of the China Banking and Insurance Regulatory Commission on carrying out notice of the Bank of China (CBI Note [2022] No. 1191) and other relevant regulatory requirements. On January 18, 2023, Yindeng Center issued the "Business Rules for the Transfer of Non-performing Loans of the Banking Credit Asset Registration and Circulation Center", which can provide services and system support such as account opening, asset registration, project listing, public bidding, information disclosure, agreement signing and fund payment for single-family transfer of public non-performing loans, batch transfer of personal non-performing loans, batch transfer of public non-performing assets and other businesses agreed by regulatory authorities.

The business of the transfer of the right of return on credit assets mainly complies with the Notice of the China Banking Regulatory Commission on Further Regulating the Transfer of Credit Assets of Banking Financial Institutions (No. 102 [2010] of the China Banking Regulatory Commission) and the Notice of the General Office of the China Banking Regulatory Commission on Regulating the Transfer of the Right of Return on Credit Assets of Banking Financial Institutions (No. 82 [2016] of the China Banking Regulatory Commission, hereinafter referred to as Document 82), the transfer rules shall apply to the Business Rules for the Transfer of Income Rights of Credit Assets of the Banking Credit Asset Registration and Circulation Center (for Trial Implementation) and the Rules for Disclosure of Information on the Transfer of Income Rights of Credit Assets of the Banking Credit Asset Registration and Circulation Center (for Trial Implementation).

After inquiry, the normative documents related to the transfer of the right of return on non-performing assets mainly include document No. 82, the Business rules for the transfer of the right of return on credit assets of the Banking Credit assets Registration and transfer Center (for trial implementation) and the detailed rules for the Information Disclosure of the transfer of the right of return on non-performing assets (for trial implementation) have made special provisions on some rules for the transfer of the right of return on non-performing assets.

From the above-mentioned business compliance with the applicable normative documents and rules, the transfer of non-performing assets and the transfer of credit asset income rights apply different rules, the transfer of non-performing asset income rights business and the transfer of credit asset income rights business most of the rules are the same, some of the application of special rules. Because this article focuses on the transfer of credit asset income rights business, the transfer of non-performing assets, non-performing asset income rights transfer will not be explained.

2. the process of transferring the right of return on credit assets.

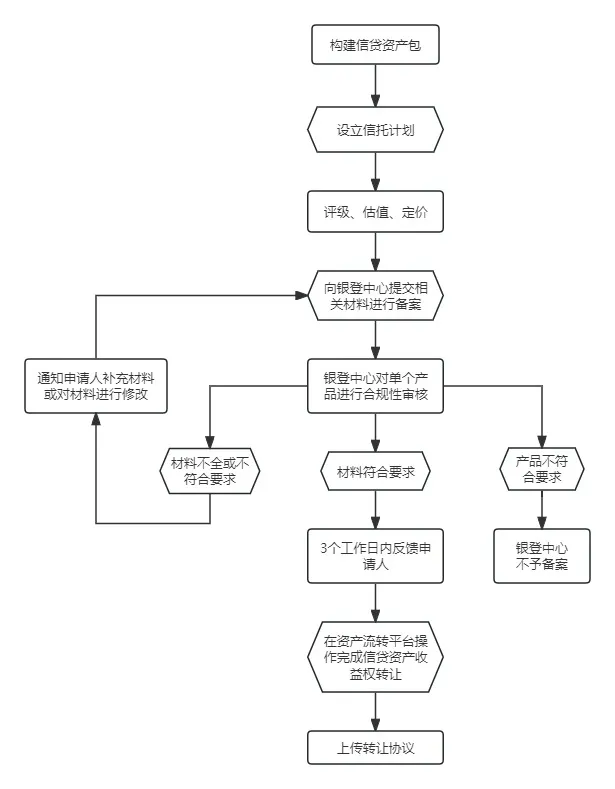

By combing through the Business Rules for the Transfer of Income Rights on Credit Assets, the operational process of the transfer of income rights on credit assets is shown in the following figure:

1, build a credit asset package.

The transferor bank constructs the credit asset package on the basis of a full assessment of the risk-return of the loan.

2, the trust company set up a trust plan to transfer the right to the proceeds of credit assets.

For the establishment of a tiered trust plan, the trust contract must specify the order of payment of the trust plan cash flow.

3, rating, valuation, pricing.

The transferor bank or trust company may choose a rating agency with the relevant qualifications to rate the credit asset yield trust scheme.

Transferor banks and trust companies may price credit assets and trust plans on their own, or they may choose to price valuations by third-party valuation agencies.

If a third-party valuation agency is entrusted with the valuation, the principal shall disclose the valuation information to the market to ensure that the pricing process is open and transparent.

4. The transferor's bank and trust company shall submit relevant materials to the Yinton Center for filing in accordance with regulatory requirements.

The filing and registration materials mainly include:

① A filing report on the transfer of credit asset income rights jointly signed by the transferor's bank and the trust company (reference format attached), including asset composition, transaction structure, accounting treatment, regulatory capital and provisioning, investor scope, information disclosure, risk warning and prevention and control measures;

② loan contracts, loan certificates, security contracts (if any), etc. corresponding to the right to proceeds of the credit assets to be transferred;

③ Draft trust contracts, loan management agreements and other relevant legal documents;

④ Independent third-party opinion (if any), such as legal opinion, accounting opinion, rating report, etc;

⑤ Other materials required by the regulatory authorities.

The above-mentioned materials must be stamped with the official seal of the transferor's bank or the issuing party of the materials, and the transferor's bank will upload the scanned electronic version (color, PDF format) to the centralized registration system of the yindeng center, and the paper documents of the filing report can be delivered or mailed to the yindeng center.

5. Yindeng Center is responsible for the compliance audit of individual products and feedback through the system.

Yindeng Center focuses on reviewing the following contents for the filing materials submitted by the applicant:

① Whether the filing materials are complete;

② Whether the composition of the underlying assets meets the transfer requirements;

Whether the transaction structure meets the requirements;

④ Whether the accounting treatment, regulatory capital and provisioning are in accordance with regulatory requirements;

⑤ Whether the scope of investors complies with regulatory requirements;

⑥ Whether the information disclosure arrangement is standardized;

⑦ Whether there are relevant risk warnings and prevention and control measures;

⑧ Other matters required to be reviewed by the regulatory authorities.

6. Yindeng Center will give feedback through the system after review.

Scenario 1. If the filing materials submitted by the applicant meet the requirements, the Yindeng Center will give feedback within 3 working days and notify the applicant to handle the registration of credit assets and the transfer of income rights;

Case 2. If the materials are incomplete or do not meet the requirements, the Silver Deng Center shall notify the applicant to supplement the materials or modify the materials;

Case 3, if the product does not meet the requirements, yindeng center will not be filed.

7, the transferor bank and the trust company received the Yindeng Center filing notice, through the asset transfer platform to complete the transfer of credit asset income rights.

The transferor's bank shall provide the registered asset information to the trust company. After the trust company confirms the transaction, both parties shall complete the asset transfer and the receipt of funds. For details, please refer to the Operation Manual of the Asset Transfer Platform of Yindeng Center.

8, the registration system automatically completes the asset transfer and equity change records, the transferor bank and trust company can print the settlement document through the system as a proof of the completion of the transfer of credit assets income rights and accounting basis.

9. The transferor's bank shall upload the transfer agreement through the centralized registration system of the Yindeng Center within 1 working day after the completion of the transaction.

3. compliance points and precautions

1. [General Requirements]]

The transfer of the right of return on credit assets shall comply with the relevant requirements of "reporting methods, reporting products and registered transactions".

Reporting measures: Banking financial institutions shall formulate a business management system for the transfer of credit asset income rights; the banking credit asset registration and transfer center (hereinafter referred to as Yindeng Center) shall, in accordance with the relevant requirements of the CBRC, formulate and issue business rules and operating procedures for the transfer of credit asset income rights, and submit them to the CBRC for the record in a timely manner.

Reporting products: Yindeng Center shall, in accordance with the relevant requirements of the CBRC, formulate and publish the product reporting process and filing audit requirements; banking financial institutions shall submit product-related information to Yindeng Center on a case-by-case basis.

2. [Centralized Registration]]

The transferor bank shall, in accordance with the requirements of No. 82, handle the centralized registration of the transfer of the right to the proceeds of credit assets at the Silver Den Center.

3. [Transfer mode]]

Banking financial institutions transfer the right to income from credit assets in accordance with the model of the establishment of a trust plan by a trust company and the transfer of the right to income from credit assets of commercial banks.

4. [Qualified Investor Requirements]]

Investors in the right to return on credit assets should continue to meet the relevant regulatory requirements for qualified investors. Investors in the right to return on non-performing assets are limited to qualified institutional investors, and bank wealth management products, trust plans and asset management plans subscribed by individual investors shall not be invested.

5. [Selection of credit assets]]

The transferor bank should carefully select the underlying assets, giving priority to credit assets with a distribution of expected cash flow recoveries that matches the repayment period of the trust plan, and a more mature valuation method for the pledge. The right to return on normal credit assets and the right to return on non-performing credit assets should be transferred separately, and the transferor bank cannot construct a hybrid credit asset package.

6. [Prohibition of False Transfer]]

The transferor bank shall not invest directly or indirectly in the right to return on the Bank's credit assets through the Bank's wealth management funds, and shall not assume explicit or implicit repurchase obligations in any way.

7. [Capitalization]]

The transferor bank shall, in accordance with the Measures for the Management of Capital of Commercial Banks (for Trial Implementation), fully capitalize the original credit assets after the transfer of the right to income from the credit assets.

8. [Provision]]

The transferor bank shall, in accordance with the relevant provisions of the Measures for the Administration of Loan Loss Provisions for Commercial Banks, the Guidelines for the Provision of Loan Loss Provisions for Banks and the Measures for the Administration of Reserve Provisions for Financial Enterprises, make provisions in accordance with the accounting treatment and the actual assumption of risks.

9. [Information Disclosure]]

The disclosure of information related to the transfer of the right of return on credit assets shall be made through the business system of the Silver Deng Center, the Silver Deng Network (www.yindeng.com.cn) or other means approved by the CBRC.

10. [Information Change Registration]]

In the event of a change in credit assets during the life of the loan resulting in inconsistency with the information registered at the Silverboard Center, the loan manager shall promptly register the change at the Silverboard Center.

11. [Expiration of Trust Plan]]

When the trust plan matures, the credit assets that have not yet been fully paid can be disposed of by the loan manager in a market-oriented manner in a standardized and transparent manner, and the recovered cash will be used for the payment of the trust's beneficial rights.

12. [Trust liquidation]]

The trust company shall do a good job in the distribution of trust benefits and liquidation after the termination of the trust. The trust company liquidates the trust plan in accordance with the trust contract and distributes the cash recovered from the realization of the trust property, or the original state of the trust property, or other legal compliance methods as agreed in the contract.

Key words:

Related News

Zhongcheng Qingtai Jinan Region

Address: Floor 55-57, Jinan China Resources Center, 11111 Jingshi Road, Lixia District, Jinan City, Shandong Province