Viewpoint... Incoterms.®2020 Terms Interpretation

Published:

2023-10-23

The Incoterms (International Rules for the Interpretation of Trade Terms, abbreviated/hereinafter referred to as Incoterms) are the basic international rules of international trade formulated by the International Chamber of Commerce. Although it is not law, it is binding upon confirmation by the buyer and seller.

The Incoterms (International Rules for the Interpretation of Trade Terms, abbreviated/hereinafter referred to as Incoterms) are the basic international rules of international trade formulated by the International Chamber of Commerce. Although it is not law, it is binding upon confirmation by the buyer and seller.

The Incoterms was first formulated by the International Chamber of Commerce in 1936. It clarifies the responsibilities and obligations of buyers and sellers, and stipulates the responsibilities of shippers, carriers and receivers/consignees to facilitate the operation process of international trade and better resolve disputes. With the development of international trade, the application and interpretation of Incoterms are facing a variety of new problems. The International Chamber of Commerce has revised it eight times, and the latest version is the Incoterms.®2020 "(hereinafter referred to as" Incoterms®2020 ").

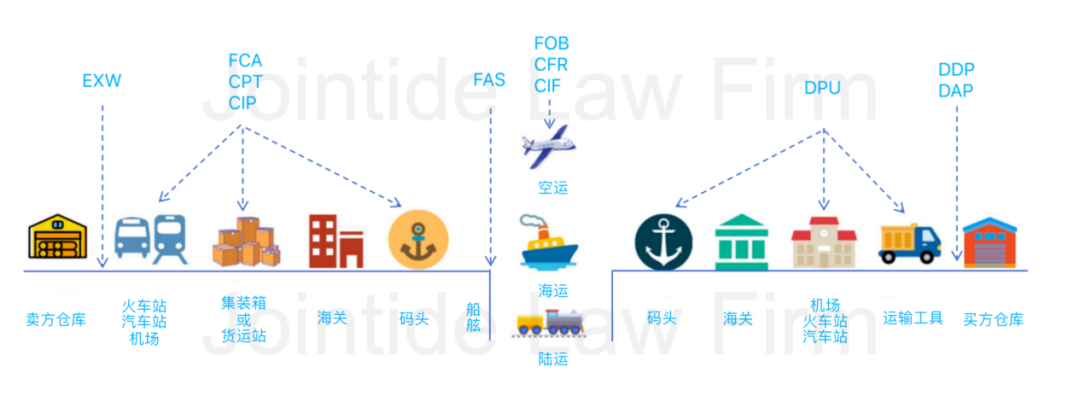

The whole process of international trade includes the seller's delivery from the warehouse, by train/car/plane and other means of transport, through the customs of the seller's country, from the terminal of the seller's country to the buyer's domestic terminal by air, sea, land, etc., and then through the customs of the buyer's country to transport the goods to the buyer's warehouse by means of transport. Incoterms®The 2020 consists of 11 terms, which are clearly defined for different nodes in international trade:

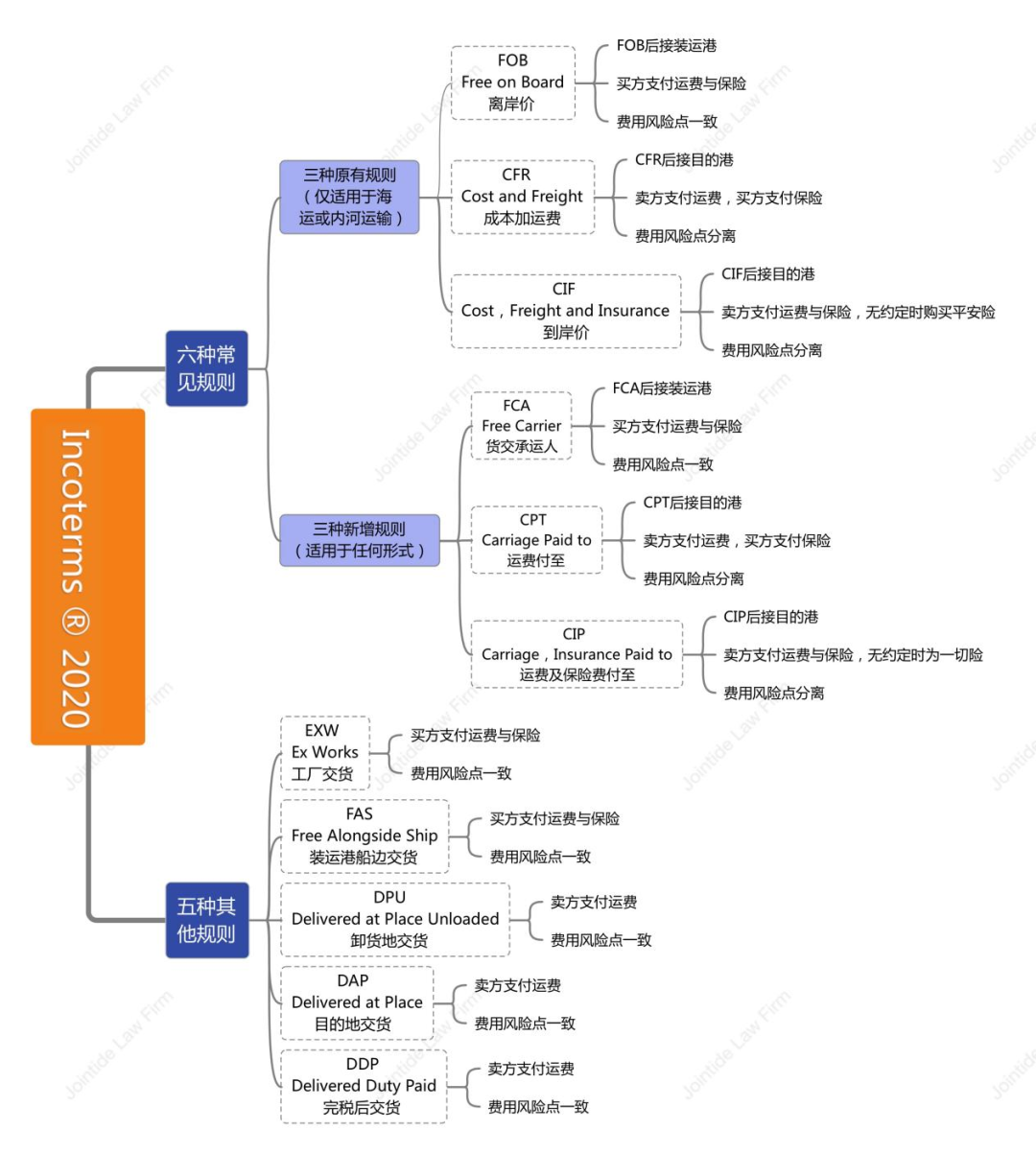

Incoterms®The 11 terms 2020 clearly agree on the sharing of responsibilities between buyers and sellers, which I summarize as follows:

What are the potential advantages and disadvantages of each term? How to choose a term? First, it depends on whether it is the seller or the buyer; second, the level of expertise in international trade of the party making the choice; and third, the level of purchasing power. From the perspective of the seller and the buyer to analyze the advantages and disadvantages of each term, the author summarizes the figure as follows, after which the term will be analyzed one by one.

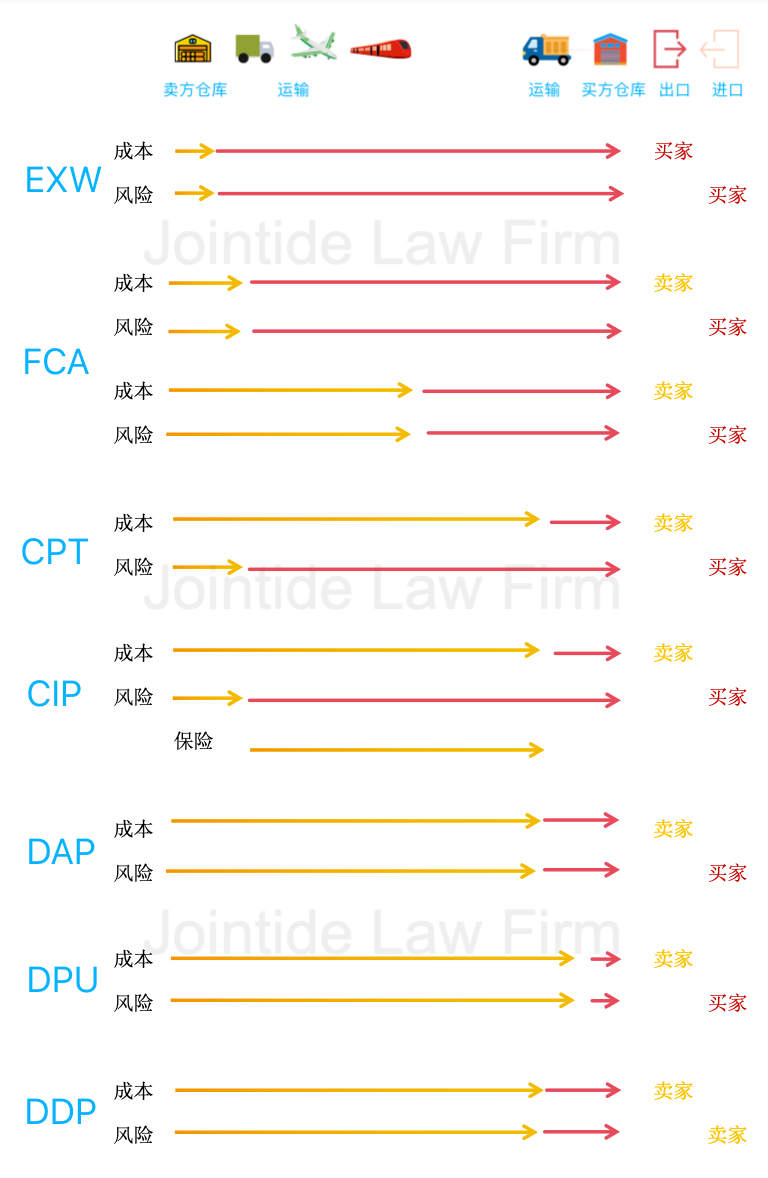

EXW(Ex Works/Factory Delivery)

EXW (Factory Delivery) is used to describe the seller's delivery of goods at its place of business (usually a factory, office or warehouse). The seller only needs to prepare the goods and place them at the agreed place, and the buyer loads and transports the goods himself. The seller does not have to bear the transportation, insurance costs and risks of the goods after leaving its premises, and EXW is more advantageous to the seller in terms of trade costs. In the case of the buyer, the buyer is free to choose the mode of transport and the carrier, and can also determine the mode of loading the goods on demand; however, once the seller informs the buyer that the goods in the contract have been identified and stored, delivery is completed and the buyer begins to bear the risk and is obliged to pay, even if the goods are still in the possession and physical control of the seller. In practice, the seller is not obliged to load the goods onto the buyer's means of transport for delivery, and it is difficult for the seller to allow the buyer's carrier to move completely freely in the warehouse. If the goods are exported, more problems arise. For example, the buyer must clear the goods for export, but in most countries, only companies registered in the country can export the goods. Furthermore, EXW has potential VAT/GST issues. Unless the seller has evidence of the export of the goods, the seller must pay the relevant taxes and fees, as this part of the goods will be regarded as domestic/local sales.

FCA(Free Carrier/Cargo Carrier, Place of Export)

In FCA (delivery carrier) terminology, the seller is only responsible for delivering the goods to the buyer or its designated carrier, and the goods may be loaded on the pick-up vehicle at the seller's premises or transported to another location (usually the carrier's warehouse, airport or container terminal). The seller goes through the export formalities and the buyer goes through the import formalities. It can be seen that FCA is an improvement over EXW because the seller is responsible for the actual delivery of the goods and the risk is transferred to the buyer only after delivery.

Incoterms®The 2020 introduced a new obligation on the buyer, namely, the buyer's obligation to instruct its carrier to issue a bill of lading for shipment if both parties agree. However, this rule is difficult to enforce in practice. When the seller hands over the goods to the buyer's carrier, the seller is not obliged to load the goods on board the ship, and any risk of the goods between delivery and shipment is borne by the buyer. When such a risk occurs, not only will the seller not receive the bill of lading on board, the buyer will not consider exporting the goods or even refuse to pay. This new provision was added primarily to meet the seller's demand for letters of credit, but the unintended consequence was that the seller would usually be named as the shipper on the bill of lading, thereby subjecting them to liability that they neither knew of nor could accept. This is Incoterms®The only provision in the 2020 that requires the buyer to instruct the carrier, but does not provide direct relief to the seller if the carrier fails to act accordingly.

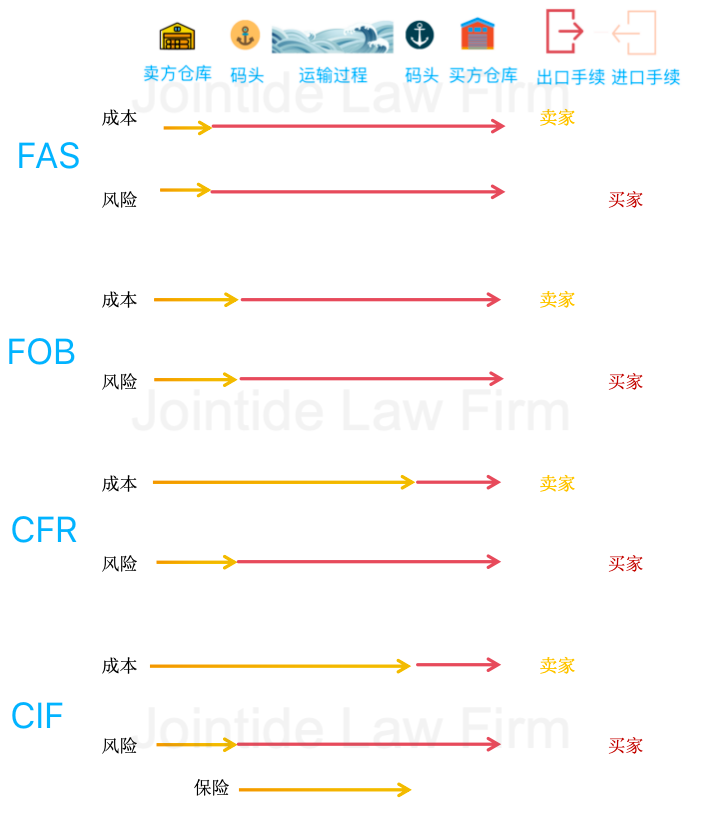

FAS(Free Alongside Ship/Port of Shipment)

The FAS term dates back to the era of sailing ships, which requires the seller to place the goods next to the ship designated by the buyer, but is not responsible for loading and transporting the goods, and does not need to purchase insurance. The responsibilities and obligations of the seller are clear.

FAS is rarely used today, but it is still usually suitable for heavy machinery transportation. These heavy machinery are brought to the dock or barge and loaded by the buyer or its ship's equipment. The goods can only be delivered if there is a ship adjacent to it at the port of shipment. The seller is responsible for the export procedures, the buyer is responsible for the import procedures. The buyer contacts the carrier and the shipper on the bill of lading is the buyer and not the seller. It is likely that the seller will require at least one copy of a mate's receipt or other form of export evidence (e. g. a copy of the bill of lading for VAT/GST purposes).

FOB (Free on board/FOB)

The FOB term is the most commonly used trade term, dating back to the days of sailing ships. Incoterms®The 2020, as in the previous version, requires the seller to place the goods on a ship designated by the buyer and notify the buyer. Subsequently, the risk of loss or damage to the goods passes to the buyer. However, the seller is unable to deliver on time due to the buyer's reasons, such as the delay of the ship contacted by the buyer, etc., once the goods are specified (marked) under the contract, the risk transfer time can be advanced. "On board" is no longer defined as the placement of the goods "over the ship's rail", which will be specified by the contract according to the nature of the goods. The seller is responsible for the export procedures, the buyer is responsible for the import procedures. The freight is paid by the buyer and the bill of lading usually states "freight to pay". The buyer contacts the carrier and the shipper on the bill of lading is the buyer and not the seller. It is likely that the seller will require at least one copy of a mate's receipt or other form of export evidence (e. g. a copy of the bill of lading for VAT/GST purposes). In the case of a letter of credit, the seller is usually shown as the shipper on the bill of lading. In this case, the seller may have additional liability under the terms and conditions of the bill of lading.

According to Incoterms®2020,FOB is not suitable for container transportation because the goods are handed over to the carrier at a certain distance from the port, such as the container yard or the seller's business premises.

CFR(Cost and Freight/Cost plus Freight)

The CFR term is one of the most commonly used trade terms after FOB, dating back to the era of sailing ships. Incoterms®The 2020 rules, as in the previous version, require the seller to place the goods on a vessel with which it is connected. Subsequently, the risk of loss or damage to the goods passes to the buyer. "On board" is no longer defined as the placement of the goods "over the ship's rail", which will be specified by the contract according to the nature of the goods. The seller is responsible for the export procedures, the buyer is responsible for the import procedures. Freight is paid by the seller and the bill of lading usually states "freight prepaid". The seller completes delivery at the port of loading, subject to the payment of freight to the port of destination where the buyer is obliged to receive the goods from the carrier (given that the word "carrier" does not appear elsewhere in this term, it may be better to express it as "receiving the goods from the ship"). The seller and the buyer shall agree in the contract which party shall pay the cost of unloading. The seller is required to give the buyer a timely notice of shipment so that the buyer can purchase insurance in a timely manner.

According to Incoterms®2020 to the rules, CFR does not apply to container traffic because the goods are handed to the carrier at a certain distance from the port, such as the container yard or the seller's premises.

CIF (Cost, Freight and Insurance/CIF)

The CIF terminology differs from the CFR terminology in only one way: in the CIF terminology, the risk transfer point (on board) is separate from the cost transfer point (port of destination). The seller is obliged to purchase the minimum insurance for the buyer (according to the association's cargo insurance (Institute Cargo Clauses) clause (C) or similar clause). The seller must provide the buyer with a certificate under the insurance policy or policy-this document usually proves that the seller is the insured party, so the seller must endorse the document in blank on the back so that the buyer can make a claim if needed.

CPT(Carriage Paid to/Freight Paid to)

The CPT term requires the seller to deliver the goods to the designated transport company or carrier and bear the transportation costs and risks. As with the FCA, the risk passes to the buyer immediately after delivery. The place of delivery in the seller's country (the point of transfer of risk) and the destination of the seller's contract of carriage (the point of division of the transport costs) are separate.

In this term, the seller completes delivery by delivering the goods to the carrier, but for the buyer, it does not know not only the time and place of delivery, but also to whom the goods are delivered (the carrier contacted by the seller). It is not easy for the buyer to control the risks that exist after the goods are delivered and before they are exported. In addition, in the transport link, the seller is not obliged to load the goods before a given date, but because the seller uses its own contracted carrier, it is easy to obtain a bill of lading that has been loaded.

CIP(Carriage,Insurance Paid to/freight and insurance paid to)

The CIP term is similar to the CPT term, but with one very important difference: the term requires the seller to purchase maximum insurance under the Association Cargo Insurance (Institute Cargo Clauses) Clause A or aviation or similar terms. The seller must provide the buyer with any insurance documents it requires in order for the buyer to make a claim under the insurance.

DAP(Delivered at Place/Destination Delivery)

The DAP term requires the seller to deliver the goods to a place designated by the buyer (usually the buyer's place of business) and the buyer is responsible for unloading the goods. The seller is responsible for the export procedures, the buyer is responsible for the import procedures.

As with the CPT and CIP terms, the place of delivery is already at the buyer's location and the seller is not obliged to insure the buyer. The term is applied to the transport of goods by land within the European/Central Asian continent, but potential problems arise once the mode of transport changes along the way.

For example, if the goods are transported by air and import clearance is required in the country of destination, it must be done by the buyer when the goods arrive at the airport. Once customs clearance is complete, the seller's carrier (usually a freight forwarder) must obtain the necessary documents to transport the goods from the airport to the final destination. The same situation exists for transoceanic container transport, but it is more complicated by the fact that empty containers must be returned by the seller at his own expense. It should also be noted that the consignee on the bill of lading should be the seller, not the buyer. The seller arranges for its freight forwarder to take over the goods from the airline or shipping company and arrange for local inland transportation. If the goods are damaged or lost at any stage before the final destination, the seller will not be able to deliver the goods, which is likely to result in a breach of contract, and the buyer has already paid import duties and VAT/GST. If the buyer is unable to complete the import clearance in a timely manner, it may be subject to the risk that the goods are under customs control.

DPU (Place of Delivery Unload/Place of Disload Delivery)

DPU term is Incoterms®2020 new rules. Although it is often said that it only changed the name of the previous DAT (dock delivery), in fact DPU also made some changes to DAT.

The DAT itself was added in 2010 as an extension of DEQ (delivery at the dock) to cover any mode of transport. In this term, the seller delivers the unloaded goods to the dock (open land such as a container yard or a covered warehouse such as an airport). The term is feasible for overland transport within the European/Central Asian continent. For express package delivery, this represents what typically happens when a driver removes a package from a truck and hands it to a buyer. It remains to be seen how the heavier packages transported by air and transoceanic containers will work in practice.

The seller's carrier must not only obtain the appropriate documents from the buyer to take over the goods from the airline or shipping company, but must also complete the unloading at the destination. For containers, this may mean the need to provide additional labor, forklifts and pallet trucks to move the goods within the container. There may also be potential insurance and safety issues when labor and machinery not employed or contracted by Buyer is operating on Buyer's premises.

DDP(Delivered Duty Paid/Delivery After Tax)

DDP is the term in which the seller bears the most responsibility and bears the most expenses among the 11 terms. Its function is very similar to DAP, the most important difference is that the seller is obliged to clear the goods in the buyer's country and pay customs duties and VAT/goods and services tax. This term is the only rule that the seller is responsible for the customs clearance of imports. The seller should use this term with caution, as the seller may need to be an import and VAT/GST registered company in the buyer's country, I .e. the term should not be chosen if the seller cannot obtain an import licence directly or indirectly. If the seller finds itself unable to become an importer or recover the VAT/GST paid, the parties shall enter into a contract in accordance with DAP or DPU terminology. As a buyer, choosing this term is not subject to additional tariffs, which reduces uncertainty and risk.

To sum up, FOB, CFR, CIF and FAS terms are only applicable to sea or inland transport, while FCA, CPT, CIP, EXW, DPU, DAP and DDP terms are applicable to any mode. For the buyer, the cost and risk incurred under the DDP term is the least and the cost and risk incurred under the EXW term is the greatest; the opposite applies to the seller. In international trade, buyers and sellers fully consider the costs, responsibilities and risks to be borne, and choose suitable trade terms on the basis of the principle of equality and mutual benefit, which can reduce the hidden dangers in the performance of the contract in order to perform smoothly.

Key words:

Related News

Zhongcheng Qingtai Jinan Region

Address: Floor 55-57, Jinan China Resources Center, 11111 Jingshi Road, Lixia District, Jinan City, Shandong Province