Viewpoint... Based on the basic legal relationship of the contract of sale and purchase, the direction and method of the bill dispute case litigation.

Published:

2023-10-23

When there is a situation where a commercial promissory note cannot be paid, the creditor has two claims based on the identity of the party to the contract and the holder of the bill, namely, the claim based on the contractual relationship and the right of recourse based on the bill under the bill relationship. In the event of a competition between the two, the creditor may choose to exercise the right of action.

[Abstract]]In a contract in which a commercial promissory note is used as a method of payment, there are two kinds of legal relationships, one is the legal relationship of the underlying transaction, such as the contract of sale, and the other is the debt and debt relationship under the bill, I .e. the holder enjoys the claim to require the drawer to pay. When there is a situation where a commercial promissory note cannot be paid, the creditor has two claims based on the identity of the party to the contract and the holder of the bill, namely, the claim based on the contractual relationship and the right of recourse based on the bill under the bill relationship. In the event of a competition between the two, the creditor may choose to exercise the right of action.

Key words]Electronic commercial acceptance bill of exchange contract dispute bill recourse dispute.

[Introduction]]

The legal relationship of the contract of sale is one of the most common legal relationships in legal practice. In this legal relationship, the payment of the purchase price is the core obligation of the buyer, and the electronic commercial acceptance bill has become a widely recognized payment method because of its convenience, liquidity, low cost of capital occupation, and high adaptability to the credit of the market economy. At the same time, however, electronic commercial acceptances are accepted by payers other than banks, which not only means that their liquidity is significantly lower than that of banker's acceptances, but also means that the payee or bearer may be at risk of not being able to pay the amount due.

When the buyer fulfills the payment obligation with the electronic commercial acceptance bill and the seller does not actually obtain the payment from the bill payment obligation, as the seller, can claim the right from the two litigation directions of the contract of sale dispute and the bill recourse dispute, and this paper makes a preliminary legal analysis from the agent's point of view.

[main text]]

1. Alternative Direction of Litigation

In a contract in which a commercial promissory note is used as a method of payment, there are two kinds of legal relationships, one is the legal relationship of the underlying transaction, such as the contract of sale, and the other is the debt and debt relationship under the bill, I .e. the holder enjoys the claim to require the drawer to pay. When there is a situation where a commercial promissory note cannot be paid, the creditor has two claims based on the identity of the party to the contract and the holder of the bill, namely, the claim based on the contractual relationship and the right of recourse based on the bill under the bill relationship. In the event of a competition between the two, the creditor may choose to exercise the right of action, not at the same time.

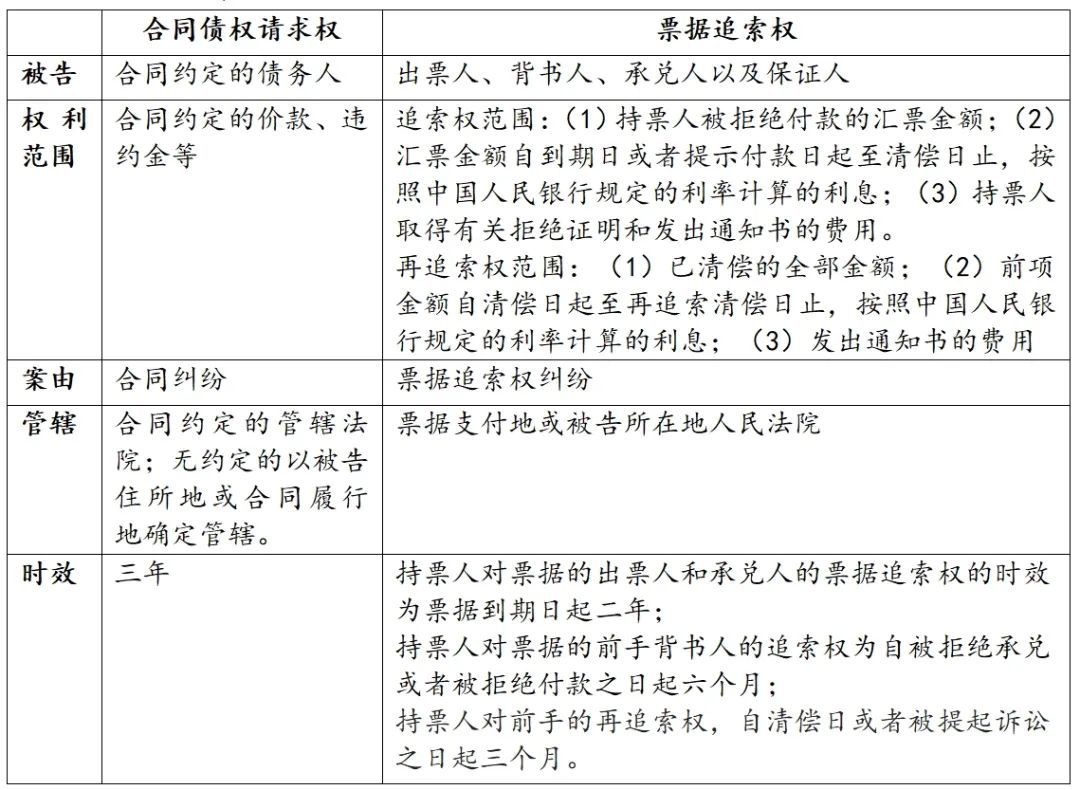

Generally speaking, the main differences between the two are as follows:

2. Judicial Practice on Two Kinds of Litigation Directions

For the two litigation directions, there are the following disputes and problems in theory and judicial practice. Different local courts and different judges have different opinions and judgment results.

Can (I) claim another claim when a creditor chooses to claim but is not liquidated?

Some referees argue that the creditor's option should be limited to one choice only. If a creditor chooses to claim a contractual right, whether or not it is paid off, it may no longer claim a right in the instrument or claim additional payment with a right in the instrument, otherwise it will lead to confusion in the application of the law; by the same token, a creditor may no longer claim a right against the contractual debtor after claiming a right in the instrument.

Some referees argue that a creditor has the right to sue with one claim but is not satisfied, and then sue with another claim. Because the two lawsuits are different in terms of the parties, the subject matter of the lawsuit, the claim, etc., they do not constitute repeated prosecutions. Moreover, the subject matter of the later action has been deducted from the portion of the previous action that has been liquidated, so it does not detract from the interests of the debtor and the creditor will not be double liquidated.

Does the (II) pay for the goods by means of an electronic commercial promissory note have the legal consequence that the buyer has fulfilled its obligation to pay?

Some judges hold that the bill has no cause, and once the bill relationship is established, it is separated from the basic cause relationship. In order to perform the contract of sale, the buyer pays the money by bill, and the seller signs the bill, it may be deemed that the purchase price has been paid.

Some judges held that although the buyer endorsed and transferred the electronic bank acceptance bill to the seller for payment of the purchase price, the bill failed to accept it due to the seller's reasons, the seller did not actually obtain the purchase price, and both parties did not agree to deliver the bill, I .e. the right to claim the contract price was extinguished. therefore, the buyer did not actually perform the obligation to pay the purchase price, and the seller still had the right to claim the purchase price from the buyer based on the legal relationship of the contract.

When the (III) signs the bill but has not been actually paid, how to deal with the bill after the payment is claimed in accordance with the contract of sale?

Since some courts have supported that rights can still be claimed under the contract of sale after the receipt of the instrument, will this result in the same subject having both the right to the instrument and the underlying claim, and double settlement of the same sum of money? Once the underlying claim is claimed, is it necessary to return the instrument that has been signed? What if the instrument is in fact unreturnable?

Some judges hold that if the parties have signed for the bill, if they continue to claim the purchase price in accordance with the contract of sale, they need to return the bill. If the instrument is no longer returnable, the parties may no longer claim in accordance with the contract of sale, so as to avoid duplication of payment. Then, at this time, the claim for the purchase price by the contract of sale will be rejected in its entirety. The parties can only bring a separate case of dispute over the right of recourse to the bill and demand payment from the bill obligor. At this time, the bill rights may have expired.

(IV) the bill is presented for payment before the due date, but the refusal occurs during the prompt payment period, does the holder lose the right of recourse against the forehand?

Part of the referee's point of view: according to the "electronic commercial bill of exchange business management approach" article 66 on "the holder in the prompt payment period is refused to pay, may refuse to pay recourse to all the forehand" provisions, whether the holder loses the right of recourse to the forehand, the key depends on the acceptor refused to pay the time. That is, as long as the acceptor does not refuse to pay before the maturity date of the bill, the holder has the right of recourse against all forehand. After searching the case of the cause of the bill recourse, such a judgment view is not an isolated case.

Some judges held that the holder of the ticket can enjoy the right of recourse against the forehand only if the two conditions are met when the holder prompts payment during the prompt payment period and is refused payment during the prompt payment period.

3. Analysis of the Advantages and Disadvantages of Two Litigation Strategies

(I) such as the choice of basic legal relationship claims-the contract of sale claims the right to sue.

1. Basic information

(1) Defendant: Buyer of a contract of sale

(2) Jurisdiction court: the jurisdiction court agreed upon in the contract; if there is no agreement, jurisdiction shall be determined by the place of domicile of the defendant or the place of performance of the contract.

(3) The main claim: payment of the outstanding purchase price and payment of liquidated damages or interest.

(4) Main evidence: "contract of sale", warehouse receipts, warehouse receipts, settlement documents and other important process evidence of the performance of the contract, the buyer's payment vouchers and invoices have been issued, electronic commercial bills of exchange prompt payment records and proof of refusal to pay (notarial certificate).

2. The advantages

(1) The court of jurisdiction is mostly the court of the buyer's domicile or the court of the seller's domicile, which is more convenient for the seller, can reduce the seller's litigation time cost, facilitate the communication of the case, and facilitate the implementation of the results of the case.

(2) For most of the more standardized commercial subjects, the sale and purchase contract as the company's main business contract type, the contract custody and evidence retention are more perfect, the case facts part of the proof difficulty may be relatively small.

3. Adverse and risk points

(1) The judge may consider that the seller's signature of an electronic commercial promissory note is deemed to have fulfilled the buyer's obligation to pay, and the claim may be rejected;

(2) If the claim is rejected, the judge may reject the claim again on the ground that the right of action can only be exercised in one of the cases, and at this time, the three-month period of re-recourse against the forehand and the six-month period of recourse against all forehand is likely to have expired and the right is lost.

(II) If you choose to sue on the basis of bill rights-bill recourse.

From the point of view of legal practice, from the point of view of the legal facts of the instrument may be subdivided into recourse and re-recourse:

1. The right of recourse shall be exercised for a period of six months from the date of refusal of acceptance or refusal of payment, and the scope of the right of action shall be provided for in article 70 of the Bill Law.

Defendant: All debtors of the instrument (drawer, acceptor, all forehand)

Jurisdiction: Choose the court of domicile of one of the predecessors

The principal claim: 1. All debtors jointly and severally pay the amount of the bill of exchange for which the seller was refused payment and pay interest at the interest rate set by the Chinese People's Bank (from the due date or prompt payment date to the date of liquidation);2. All debtors jointly and severally pay the seller's costs (if any) for obtaining the certificate of refusal and giving notice.

Main evidence: the main evidence to prove the existence of entity transactions, such as sales contracts, invoices, settlement records, etc.

2. The exercise of the right of re-recourse shall be exercised for a period of three months from the date of liquidation, and the scope of the right of action shall be in accordance with Article 71 of the Bill Law.

Defendant: All debtors of the instrument (drawer, acceptor, all forehand)

Jurisdiction: Choose the court of domicile of one of the predecessors

The principal claim: 1. All debtors jointly and severally pay the full amount of the seller's settlement and pay interest at the interest rate prescribed by the Chinese People's Bank (from the date of settlement to the date of re-recourse settlement);2. All debtors jointly and severally pay the seller's notice (if any).

Main evidence: the main evidence to prove the existence of entity transactions, such as sales contracts, invoices, settlement records, etc.

3. The advantages

(1) In practice, the seller legally obtained the bill of exchange involved on the basis of the contract, the electronic commercial acceptance bill records complete, continuous endorsement, is a valid bill, the seller is the legal holder, according to the law to enjoy the rights of the bill.

(2) If the seller performs online recourse and prompt payment procedures in strict accordance with the Bills Law, the Measures for the Administration of Electronic Commercial Bills of Exchange and other laws and regulations on electronic commercial promissory notes, then the seller's rights in the bills are more complete, and under the framework of the existing laws and regulations on bills, the seller's rights are more likely to be supported.

4. Adverse and risk points

(1) If the payment is not prompted during the prompt payment period, even if the payment obligor refuses to pay during the prompt payment period, if the presiding judge tends to approve the view that the holder can have recourse to the forehand only when the two conditions are met during the prompt payment period and the payment is refused during the prompt payment period, then the claim to the forehand may still not be supported, and the seller will only have recourse to the drawer and the cashier, this will directly lead to a reduction in the number of defendants, which in turn will lead to a reduction in the likelihood of reimbursement.

(2) If the case has been partially substantive reviewed at the stage of pre-litigation mediation or filing review, and the reviewers are also inclined to approve the view that both conditions need to be met, or some defendants defend and raise jurisdictional objections on this ground, then the case may be transferred to jurisdiction (e. g. it may be transferred to the court of the acceptor's domicile).

(3) According to the bill right and the defendant to distinguish, the bill right prosecution may need to be divided into multiple cases according to the endorser and whether it belongs to the right of re-recourse, corresponding to different defendants and claims, may involve multiple jurisdiction courts, the seller and the seller's agent's cost and workload will be increased, the communication will be more difficult, subsequent implementation may also face the practical challenge of insufficient implementation intensity if it involves off-site implementation.

4. should be taken into account in the agent's thinking.

Although it is convenient and relatively low cost for the (I) to sue the seller based on the basic legal relationship-the sales contract relationship, considering the actual adjudication risks such as whether the right of action can only choose one party, whether the bill of exchange will be deemed to have fulfilled the payment obligation, and the short term of bill recourse, the agent should still fully explain the risks that the two litigation directions may face to the parties and consult the parties to the maximum when representing such cases.

(II) carry out necessary and sufficient case search, especially search the previous judgment documents of the court under the jurisdiction of the case when the case of sale contract dispute is sued with "electronic commercial acceptance bill" as the key word, and summarize the judgment ideas and styles of the court under the jurisdiction of the case when the case of sale contract dispute is sued with the basic legal relationship after the refusal of payment of electronic commercial acceptance bill, to make further risk assessments.

(III) inquiring about the litigation information involving the defendant in the two litigation directions, the legal credit status is analyzed from the perspectives of the number of cases, the identity of the case, the result of the judgment, and the implementation, so as to further predict the implementation.

(IV), in view of the fact that the relevant data and evidence of the electronic commercial acceptance bill are recorded in the bill of exchange system in the form of electronic data, in terms of the form of evidence requirements, the operation process of the bill of exchange involved in the case, the proof of refusal to pay and other electronic data can be notarized before the lawsuit, in order to strengthen the effectiveness of the evidence.

(V) filing an application for property preservation at the same time when filing a lawsuit will facilitate the execution of the case. For some parties with more complicated financial processes, especially state-owned enterprises, the agent should advise the parties to include property preservation matters in the work plan and make a good financial budget in advance, and include procedural matters such as the purchase of liability insurance and the payment of preservation fees in the work plan in advance to prevent delays in the court's deadline.

main legal provisions]

Negotiable Instruments Act

Article 17 The right to an instrument shall be extinguished without exercise within the following periods: (1) The holder's rights against the drawer and acceptor of the instrument shall be two years from the maturity date of the instrument. See pay-as-you-go bills, promissory notes, two years from the date of issue; (II) the holder's rights against the cheque drawer, six months from the date of issue; (III) the holder's recourse against the forehand, six months from the date of refusal of acceptance or refusal of payment; (IV) the holder's recourse against the forehand, three months from the date of liquidation or the date of prosecution.

Article 70 In exercising the right of recourse, the holder may request the person against whom the claim is made to pay the following amounts and expenses: (1) the amount of the bill of exchange for which payment has been refused; the interest calculated at the rate set by the People's Bank of China on the amount of the (II) bill of exchange from the due date or the date of prompt payment to the date of liquidation; (III) the cost of obtaining the relevant proof of refusal and issuing the notice. When the person against whom the claim is made pays off the debt, the holder shall surrender the bill of exchange and the relevant proof of refusal and issue a receipt for the interest and expenses received.

Article 71 After the person against whom the claim is made has paid off in accordance with the provisions of the preceding Article, he may exercise the right of re-recourse against other bill debtors and request them to pay the following amounts and expenses: (1) the full amount already paid off; interest calculated at the rate set by the People's Bank of China from the date of settlement to the date of re-recourse (II) the amount mentioned in the preceding paragraph; (III) the cost of issuing the notice. When the person against whom the right of re-recourse is exercised is liquidated, he shall surrender the bill of exchange and the relevant certificate of refusal and issue a receipt for the interest and expenses received.

Measures for the Administration of Electronic Commercial Bills of Exchange Business

Article 13 An electronic commercial bill of exchange shall be a fixed-date payment instrument;

Article 58 The bearer shall prompt the acceptor for payment within the prompt payment period. The prompt payment period shall be 10 days from the maturity date of the bill, and the last day shall be extended in the event of a statutory holiday, a non-business day of the large payment system and a non-business day of the electronic commercial bill of exchange system;

Article 59 If the holder prompts payment before the maturity date of the bill, the acceptor may pay or refuse to pay, or pay on the due date. If the acceptor refuses to pay or fails to respond, the holder may prompt payment again after the bill is due;

Article 66 If the holder is refused payment before the maturity date of the bill, he shall not refuse to pay the recourse. If the holder is refused payment during the prompt payment period, he may recover the refusal of payment from all previous hands. If the holder is refused payment beyond the prompt payment period, if the holder has issued a prompt payment during the prompt payment period, the holder may refuse to pay the recourse to all the forehand; if the prompt payment has not been issued during the prompt payment period, the holder may only refuse to pay the recourse to the drawer and the acceptor.

Key words:

Electronic commercial acceptance bills, sales contract disputes, bill recourse disputes.

Previous article

Related News

Zhongcheng Qingtai Jinan Region

Address: Floor 55-57, Jinan China Resources Center, 11111 Jingshi Road, Lixia District, Jinan City, Shandong Province